I was deeply amused to read the breathless news coverage of Hammerin’ Hank Paulson’s “ambitious” and “sweeping” plans to restructure the federal financial regulatory structure. It says something about how far the goalposts of this country’s discourse have been moved towards rampant, unchecked, unbridled “law of the jungle” financial pillaging that modest reforms like these are considered a major move.

If these pathetic hot-flashing stenographers that call themselves “reporters” would actually take a closer look at the plan itself–hell, even just the fact sheet–they would see that not only is Paulson’s reform agenda miniscule at best, but that it’s a shell game, a distraction designed to accomplish the long-held mantra of the Bush administration–centralizing federal power and weakening consumer protections at the state level.

Some of the recommendations are good–like creating a national office tasked solely with investigating and providing oversight on mortgage originations, and merging the anachronistic Office of Thrift Supervision (OTS) with the Office of the Comptroller of the Currency, another little-heralded agency I’ll mention again later. But read these following passages I quote carefully (emphases added):

Last March, Treasury convened a blue-ribbon panel to discuss U.S. capital markets competitiveness. Industry leaders and policymakers alike agreed that the competitiveness of our financial services sector – and its ability to support U.S. economic growth – is constrained by an outdated financial regulatory framework.

So they’ve been talking about how to improve and modernize the federal regulatory structure for a year. If I recall, a year ago Fed chief Ben Bernanke was only beginning to telegraph the warnings of larger economic failure from the subprime mortgage collapse, insisting the problem was still contained. And note the language–not “protect consumers,” but “support U.S. economic growth.” Not “constrained by unscrupulous lenders, ill-informed borrowers, overly complex transactional rules, and a Fed chief who does his best impression of a box turtle,” but an “outdated regulatory framework.” Gotta love that conservative ethos–even in the face of total market failure, regulation is still Satan personified.

Back to the fact sheet:

Treasury recommends the creation of a new federal commission led by a Presidential appointee, the Mortgage Origination Commission (MOC), to evaluate, rate, and report on the adequacy of each state’s system for licensing and regulating participants in the mortgage origination process. Federal legislation should establish (or provide authority for the MOC to develop) uniform minimum qualifications for state mortgage market participant licensing systems. Treasury recommends that the Federal Reserve continue to write regulations implementing national mortgage lending laws. Treasury recommends clarification and enhancement of the Federal enforcement authority over these laws.

I’m all in favor of establishing a “minimum floor” for decent mortgage laws, but the worry I have is something succinctly espoused by Alan White at the CL&P Blog:

While the Blueprint seems to preserve a role for state financial institutions regulators, it would impose federal oversight of the quality of state licensing for mortgage originators. More significantly, it calls for the Federal Reserve to take sole responsibility for regulating lender conduct in the mortgage market. Although it is not explicit, there seems to be a call for federal preemption of state mortgage regulation. This proposal is troubling, given the activity at the state level in regulating predatory mortgage practices (with North Carolina often cited as a model) during a time when Congress took virtually no action to curb mortgage abuses.

This has been a time-honored tactic of the Bush regime for as long as I can remember–to take away power from the states and federalize it in a weaker, central, federal authority, which precludes stronger state consumer protection laws on everything from identity theft to cellphone contracts. Matter of fact, former New York Attorney General and Governor Elliot Spitzer took pains to point out how the Bush White House deliberately interfered with the states’ investigation of predatory lenders, using the Office of the Comptroller as its blunt instrument:

In 2003, during the height of the predatory lending crisis, the OCC invoked a clause from the 1863 National Bank Act to issue formal opinions preempting all state predatory lending laws, thereby rendering them inoperative. The OCC also promulgated new rules that prevented states from enforcing any of their own consumer protection laws against national banks. The federal government’s actions were so egregious and so unprecedented that all 50 state attorneys general, and all 50 state banking superintendents, actively fought the new rules. But the unanimous opposition of the 50 states did not deter, or even slow, the Bush administration in its goal of protecting the banks. In fact, when my office opened an investigation of possible discrimination in mortgage lending by a number of banks, the OCC filed a federal lawsuit to stop the investigation.

As Greg Palast astutely noted not long ago, it was no coincidence that Spitzer’s very public fall from grace happened at the exact same moment Bernanke and Paulson secured a $200 billion taxpayer-funded bailout for the faltering banks. The DOJ waved this tasty piece of candy in front of the press–“Hey, look, sex scandal! Prostitution! Democrat!“–and off they went with the intensity of Pavlov’s best dogs. And now we’re supposed to expect that the same administration that engineered and profiteered off this scandal can be trusted to craft a new regulatory framework to prevent this from happening again? Motherfucker, please.

Thankfully, at least some Democrats are challenging Bush, Bernanke, and Paulson on the “closing the barn door after the storm hits” nature of the plan. Chris Dodd is right to call this rescue plan for what it is, and as chairman of the Senate Banking Committee, he has enough clout to ensure it will never see the light of day.

The simple truth is that no amount of taxpayer-funded bailouts for banks can effectively stop the convulsions this country’s economy is going through. They can only prolong the pain that consumers will endure in the form of record-high foreclosures, deflating home prices (which are still overpriced in too many areas, ironically), and the loss of home equity as a financial cushion to bracket against everything from soaring gas prices to food costs to student loans for the kids. The terrible trio of Bush, Bernanke, and Paulson have introduced mortgage rescue plans before, remember, but they were mild at best and downright useless at worst.

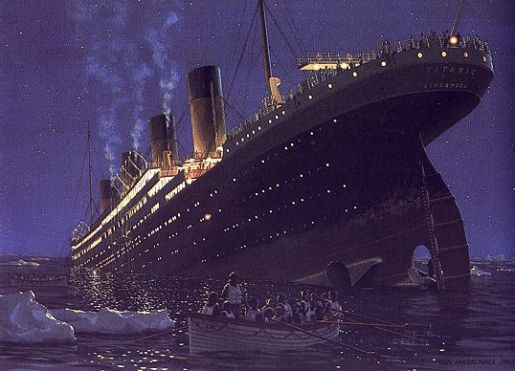

The bailout is not for you. None of these plans are for you, and they never have been. You’re just a tool, an asset being offloaded on a balance sheet, sinking with the ship. The lifeboats are already full to busting with the CEOs of Countrywide, Bank of America, Bear Stearns, and Citigroup, and there’s no room for you. Better sink or swim.

You nailed the important point: The president has sought to subvert the will of the states regarding oversight of the mortgage industry. And the notion that a “Presidential appointee” would be the chief overseer rankles (see my weekend post).

President Bush has done the same with environmental regulation as well, usurping state authority as well.

Nice work, Martin. This is a deep morass you’re leading us through competently.

The Spitzer incident did coincide remarkably well with the bank’s “bailout”. It is hard to explain to many of my friends that when you see the Spitzer story from this perspective his actions don’t seem worthy of much condemnation, as compared to the pimps of Wall St. Wonder when the NYTimes or some other “paper of record” will notice this coincidence.

Also appointing an ex-chief of Goldman Sachs to be the Treasury chief … isn’t that a bit ironic. Its clear that Congress is too meek to take any punitive action against Bush or Cheney, but I wonder if a cabinet secretary can be impeached?

And as for going down with the ship, my mama always said never put all your eggs in one basket. People would do well to heed that warning. Wall St. and the Fed are powerful only because of the choices of the American people.

The Milton Friedman policies of privatization, deregualtion, and cutting social programs have messed up many countries. Now add the US to that list. Now putting the private FED in a regulatory enforcement capacity is akin to having the fox guard the henhouse. JUST SAY NO.